Dear editor:

In The Lake Report on Feb. 15, columnist Brian Marshall wrote a rather sympathetic article, (“A concrete look at local governance,”) that essentially excused Niagara-on-the-Lake town council from appealing cases to the Ontario Land Tribunal because of budgetary constraints related to legal expenses as follows:

“It is my understanding that town council has budgeted $500,000 for 2024 legal expenses. While that may sound like a lot, using simple math at $400 per hour, that’s only 250 hours.”

“And, of course, this calculation does not consider the plethora of additional charges, which reduce that number of hours. Moreover, this budget must cover all the town’s legal expenses — not just those associated with planning issues.”

“On those issues, I’d posit that the budget may be sufficient to fund between four and six properly researched, prepared and presented cases before the Ontario Land Tribunal.”

Audited financial statements for 2022 and 2021 showed that the town made a profit (or in government lingo, had a surplus) of $4,945,031 in 2022 and $2,924,403 in 2021.

Cash in the bank totalled $22,333,108 in 2022 and $ 21,032,114 in 2021. Cash from operations totalled $8,653,141 in 2022 and $7,914,756 in 2021.

The town has only $5,476,721 of long-term debt. And actually, the financial statements say the town has assumed responsibility for the payment of principal and interest charges on certain long-term liabilities issued by other municipalities, not ours.

Why do we have to pick up debt obligations of another municipality?

I guess we’re a cash cow.

But every taxpayer is paying for this debt repayment when that $5.5-million debt repayment could have been spent on our community whether for a new swimming pool, library, community centre or, heaven forbid, going to the Ontario Land Tribunal.

The problem with members of town council is not that they don’t have the cash to go to the Ontario Land Tribunal to protect the community — they just don’t want to.

To go to the Ontario Land Tribunal, legal counsel estimates that it might cost between $25,000 and $50,000. Budgeting a reasonable amount of money for things like the land tribunal is merely an excuse not to do it. The town could easily argue on behalf of its residents in way more than six cases a year.

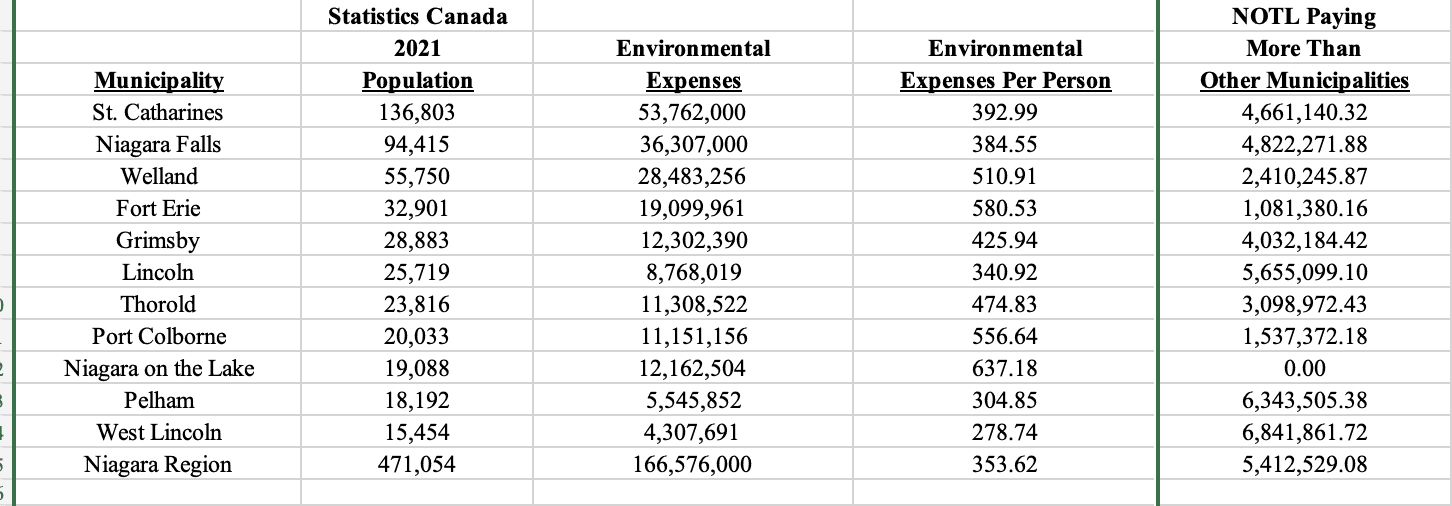

The largest expense the town has is labelled “environmental” in its audited consolidated statements. Documents state this is for sanitary, storm and water systems.

It was $13,187,941 in 2022 and $12,162,504 in 2021. When compared with other Niagara municipalities those numbers are disproportionately large. All these expenses are as of Dec. 31, 2021.

For instance, compared to West Lincoln we’re paying $6,841,861 more than a similar geographic population base. That equates to $358.43 per person in taxes in NOTL.

In summary, NOTL is subsidizing one or more other municipalities, which increases our property taxes.

Town council has enough money to do a lot of things, including defending our neighbourhoods at the Ontario Land Tribunal.

Why are we paying more in property taxes because of what appears to be an excessive amount for environmental expenses when compared with other municipalities?

Why are our property taxes going up? How is this good fiscal governance?

Gienek Ksiazkiewicz

St. Davids