So you’re thinking of building a secondary unit, or units, on your property or home.

This summer, Bill 23, the province’s More Homes Built Faster Act, came into full effect, creating a process for many landowners to double original allowances from one to two additional units of living space on their properties.

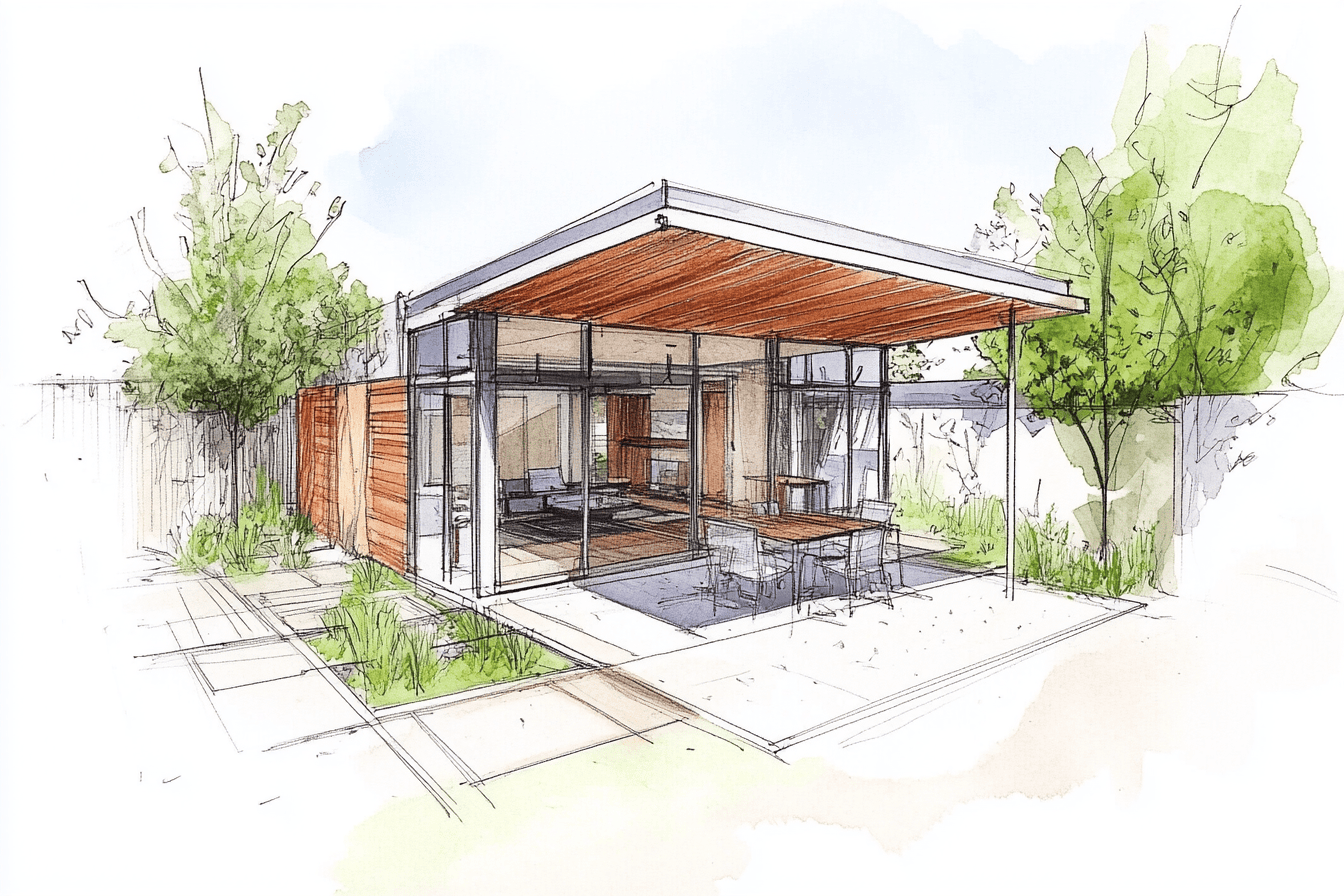

This can be done either via attached or detached dwellings.

However, key rules and regulations apply when it comes to building accessory units — such as where, how and for what purpose — before the municipality of Niagara-on-the-Lake will allow them.

“(The act) allows for units within single detached, semi-detached or townhouse,” said Kirsten McCauley, director of community and development services for the Town of Niagara-on-the-Lake.

“So, that could be that you have your primary house and then you could have an additional residential unit within, say, your basement apartment.”

“Or you could have at least two units within your primary residence. The other option is the detached accessory or additional residential unit.”

Renovating space above a new or existing garage does apply, added McCauley.

Housing crunch

The need for these types of units in Niagara is real.

The region is not immune to the housing crisis being experienced in municipalities across Canada.

The vacancy rate here in Niagara is slim, from 1.1 percent on the low end in areas of Niagara Falls to just 3.4 percent in Welland-proper at the high end (note: the high ends are good ends when it comes to vacancy rates).

Adam Hawley is vice president of Traditional Neighbourhood Developments in NOTL and believes loosening the rules around adding a second or third unit to private properties is a good start, but doesn’t see it as the big solution.

“We’ve got to build a lot of homes in this in this country, and it’s not all going to be done with accessory dwelling units,” he said.

“It’s not going to solve the problem, but it’s a piece.”

What these types of dwellings do accomplish, he said, is adding space for people to live without going as far as to take up other valuable land within municipalities with larger structures such as apartment buildings.

“I think a lot of times (an accessory dwelling) can be a very good tool because it sort of brings in gentle density,” he said.

Bonus feature of new laws

Bill 23 hangs another attractive feature in front of interested people.

The act eliminates development charges for homeowners, a move that will save thousands of dollars.

This will be very attractive to people looking to supplement their income, or add space for loved ones such as elderly parents or adult children who are unable to buy a home of their own due to high costs associated with home ownership these days.

“It helps because the cost of construction has gone up so drastically,” said Hawley.

“Specifically in Niagara the regional development charges have increased significantly in the last four years,” he added.

And just announced on Oct. 8 by Minister of Finance Chrystia Freeland are additional measures to help create accessory dwellings in Canadian homes.

Those changes are to existing mortgage insurance rules for the construction of accessory dwellings.

“Effective Jan. 15, 2025, the government will allow mortgage insurance for Canadians who intend to construct additional units not for use as a short-term rental, as long as that borrower already owns their current property and either they or a close relative are occupying a current unit,” said a media release from Freeland’s office.

Borrowers will now be able to finance up to 90 per cent of the home value, including the value added by the additional unit or units, and to pay the mortgage over a period of up to 30 years.

The plan also states that the existing residential property after the upgrades cannot exceed $2 million.

Know the rules before beginning to plan

For all of the options and reduction of costs available to interested parties, there are town zoning bylaw requirements that still have to be met.

A homeowner, said McCauley, would have to inquire on their particular property to find out what the existing zoning requirements are, adding that in an established residential zone there are two classifications for zoning, residential 1 or residential 2.

She also notes that on rural properties within the municipality, there are only allowances for one extra unit to be built.

In all cases, she notes residents would “have to meet your lot coverage,” the area of a lot the dwelling covers, “your setbacks and you’d also need a building permit.”

Setbacks, she added, are the distance between the new dwelling to the property line.

There are front-yard, side-yard and rear-yard setbacks as well as setbacks between dwellings and the primary residence, which are also zoned differently.

“The individual would need to contact the town (or visit online) to find out what their zoning requirements are,” said McCauley.

McCauley adds there has been quite a bit of interest in constructing these types of dwellings in NOTL, but is reminding people to get approval for a building permit, the dwelling must not be used as a short-term rental.