“Y’all musta figured out how to grow money in the backyard,” said the nice guy with the Harley T-shirt from Tennessee. “’Cause what people want for houses here is insane.”

He was standing in front of an array of listings in a Queen Street window. Shaking his head.

Of course, NOTL ain’t TN. This is paradise. Everybody wants to be here, right?

Anyway, the average house in that state sells for $336,000, while buyers here routinely pony up three times as much. In fact, if you want to spend 10 times that amount, you’ve come to the right place.

But wait. We also have a weird market. And some people are being clobbered by it.

First, the official news. Things are peachy. That’s the word from the local realtor cartel, which recently resumed releasing monthly data. Turns out July was good — sales up 9 per cent. New listings down 2 per cent and prices sagging less than 1 per cent.

“With mortgage rates remaining steady and a solid supply of homes on the market, this is a window of opportunity for buyers to act with more confidence,” says head wizard Lisa Taylor — who wants you to know it is still a buyer’s market, “so overpriced homes risk being left behind.”

But behind the official spin lies the reality that this has been one tough year to flog a property.

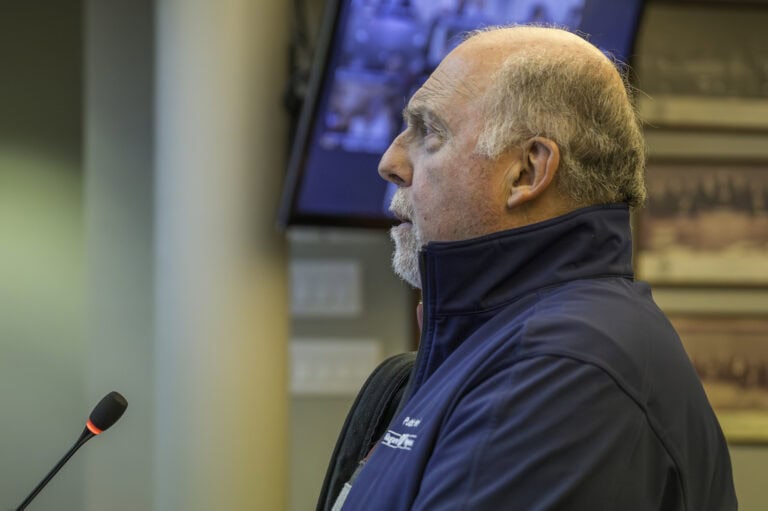

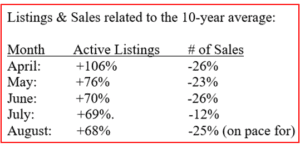

Sales have lagged far below the 10-year average while listings have swollen like a dead hippo in the sun. The accompanying chart from Bosley’s Patrick Burke summarizes the situation well.

So what’s the problem? What killed off house sales — or at least buyer enthusiasm?

Trump. Tariffs. Ontario and federal elections. Stalled mortgage rates. Economic uncertainty and the threat of recession. Elbows up and the 51st state. It’s been a scary year for most people, sapping buyer confidence.

Meanwhile, says Sotheby’s Laura Skene, a lot of NOTL sellers are delulu when it comes to understanding what their properties are really worth. They’ve turned their listings into “zombies.”

“The sellers are still chasing the market of 2022, and as a result, the homes are languishing on the market,” she tells me.

“We’re seeing these listings being cancelled and re-listed over and over again, with incremental price reductions that are not keeping pace with the market. They are clogging up the active listings and creating a false sense of oversupply, when in reality, they are simply not meeting the market where it is.”

Burke agrees. “Unless you have something special, your home will collect dust,” he says. “The market overall is riddled with failed pricing strategies.”

So what happens next?

September 17th, that’s what. On that day (in a rare coincidence) both the Bank of Canada and its U.S. counterpart, the Fed, will review their rates.

Mr. Market is currently giving 90 per cent odds the Americans will trim the cost of money that day and most Bay Street economists think our guys will do the same. It will be the first chop after months of staying on hold, waiting to see what the orange guy does next.

“It would tell buyers that the era of rising rates is over and that it’s safe to move forward with a purchase. This could lead to a surge of pent-up demand flowing into the market,” says Skene.

“The market is so starved for positive headlines,” adds Burke. “Perhaps it helps some buyers get to where they need to.”

So, a buyer’s market. Lots of out-of-touch sellers. Cheaper mortgages on the way, maybe.

Buyers advice: get pre-approved for a loan, then offer what you can afford, not what’s being asked.

Seller advice: be realistic or fail. Maybe don’t list at all.

“It’s likely a better financial decision to hold onto your property,” says Skene. “The interest rate environment has changed and selling now could mean taking a substantial loss.”

Of course, there’s always Tennessee. But after 2028.

Garth Turner is a NOTL resident, journalist, author, wealth manager and former federal MP and minister. garth@garth.ca