The house on the corner is still for sale. A year now. They got an offer the other day for 90 per cent of the asking price, but signed it back. Full price. Just under four million. The buyers walked.

What’s wrong with NOTL sellers these days?

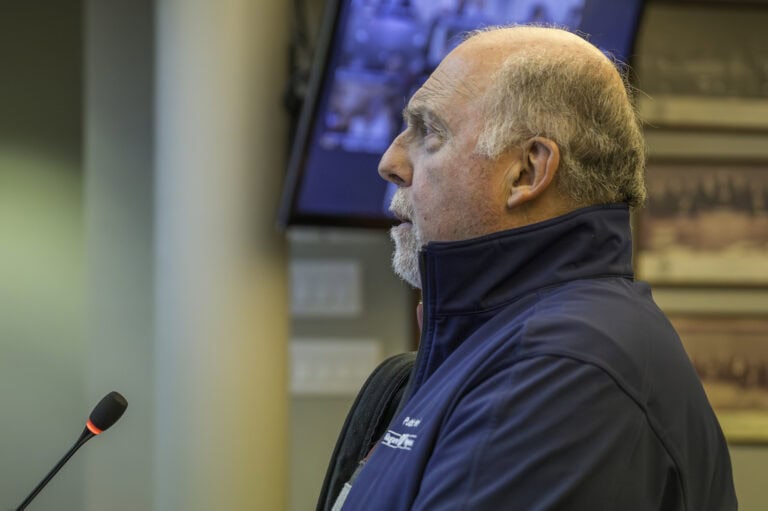

“We’re in a market that’s been in the buyer’s favour for years now,” says broker Patrick Burke. “You can’t just list, stick with your price and see what happens. Do you want to be for sale, or be sold? It’s that simple.”

Well, maybe. These are complicated times. Incentives to shovel money into real estate are building up. But so are the risks.

Buyers want deals. Sellers think 2021 is coming back. And, of course, NOTL is a weird place.

Most sales here happen between March and July — a short window. This is also the only place in the region where average values have been north of a million bucks for several years.

Overall last year prices dipped about 3 per cent, to $1.1 million. The Old Town was a hundred grand more expensive — down year over year a whopping 9 per cent. But look at Virgil. The average there was just one used Hyundai south of a million and homes appreciated almost 8 per cent.

If a certain orange guy were not in the headlines daily, screwing up the courage to make an offer would be easier.

After all, most houses are selling for less. Thirty-year amortizations are now available for newbie buyers, reducing monthly payments (but increasing the interest paid).

CMHC now offers mortgage insurance on places worth up to $1.5 million. That’s huge, since minimum downpayments on more expensive places are now 60 per cent less. And mortgage rates are pivotal. Two years ago a five-year term cost over 6 per cent. Now you can get one for less than four.

There’s more. New buyers can raid their RRSPs for tax-free house money and delay making repayments for years. That crazy First Home Savings Account lets people deduct contributions (eight thousand a year) from taxable income like an RRSP, then take it out to buy a house without any tax, like a TFSA.

It’s a gift, on top of taxpayer-backed mortgage insurance which keep rates low.

Given all this, the Bosley broker admits spring 2025 should be a boffo comeback year for houses.

But probably not.

“If tariffs kick in during early March, then that’s going to be a challenge,” says Burke.

“But we have to see if this is going to be a one-month fistfight. Or longer. Maybe an event for all of 2025. But when you look out over the past decade, this is about as fascinating a spring market as we’ve ever had.”

Bay Street economists are singing the same song lately. Steel and aluminum duties are the latest assault. Rising unemployment and falling rates are now likely. In fact, we could get back to COVID-era mortgages of less than 2 per cent. That was when real estate went nuts, despite the fact we were all going to die.

The unknown is how long this trade war might last and how effectively Canada will respond. If we make imports more expensive while suffering a lower dollar, inflation roars back. The central bank will stop chopping and might hike again.

So, a hot mess.

Already it takes an average of almost 250 days to sell a more expensive house in this town. Listings have been piling up.

When Trump granted us a 30-day stay of execution, there was a flurry of showings and activity, but mostly for cheaper digs. You know, the stuff average folks can afford. But now that window’s closing.

Moral: don’t stick millions in a house. This may not end well.

Garth Turner is a NOTL resident, journalist, author, wealth manager and former federal MP and minister.

garth@garth.ca