Mike Priore is worried about me.

Heritage woes. Tourist tsunami. Fat George. Parliament Oak. Cell towers. Garrison Airport hotel.

“For your own sanity and health, take a break for a couple of weeks and write some positive stuff,” the retired postie advises me.

“We came here for an idyllic peaceful life, right. It breaks my heart to see all the developments also. Unfortunately, some people are mistakenly worshipping money instead of giving back for a life well-lived. Sad.”

“Save the big guns when we are closer to election time so we can affect real change. Meditation, gratitude and a little kumbaya every once in a while doesn’t hurt.”

So, Mike, this is for you. A non-political column all about the glue that binds NOTLers together. Yes, residential real estate. Our other obsession.

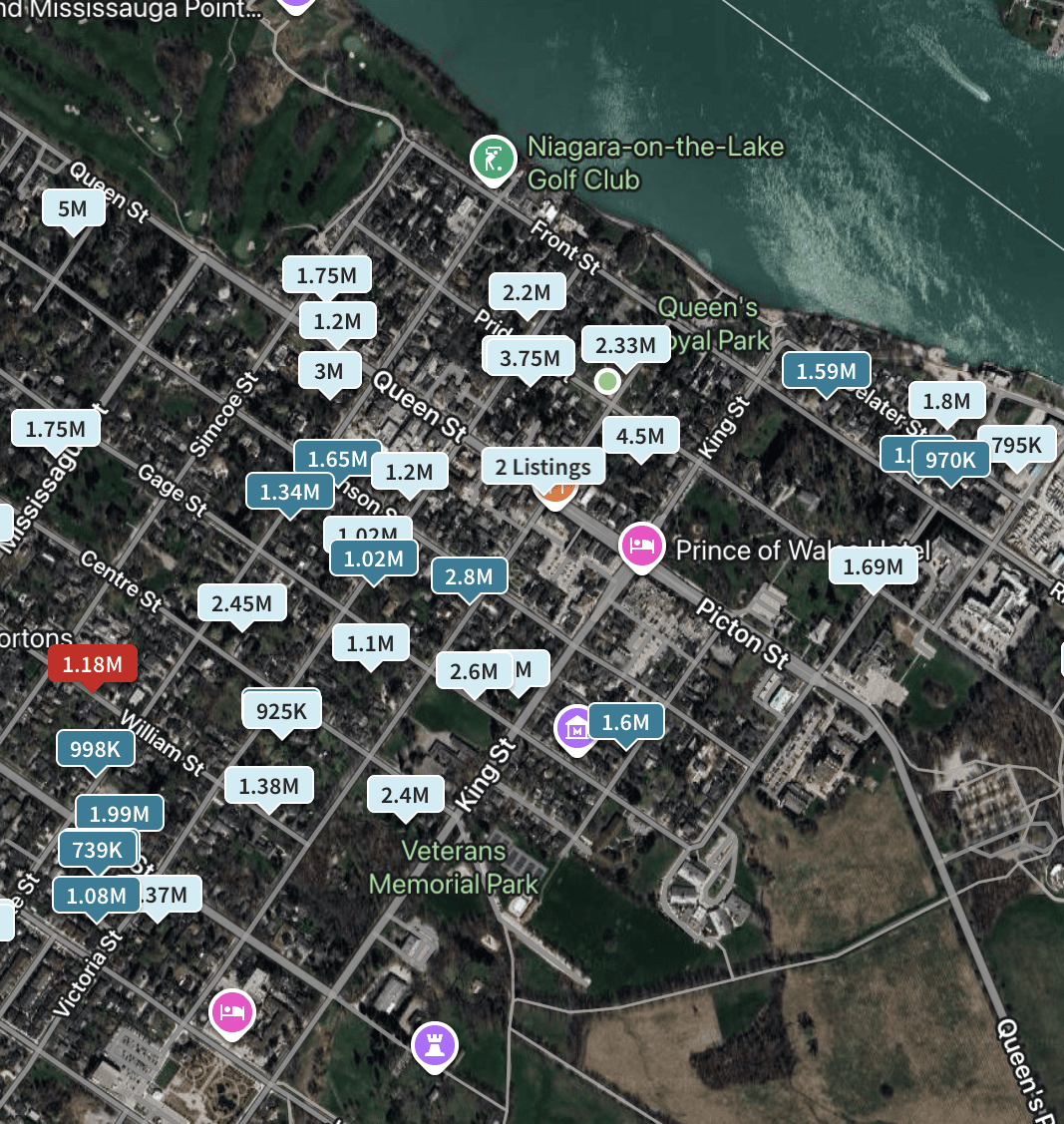

Fantastically, there are 112 properties currently for sale in Old Town. Another 60 up the road in Virgil and just as many over in St. Davids.

In all, about 300 listings in town. Sellers have surged. Buyers have not. The same holds true across Niagara, says the local realtor cartel. Inventory is up. Sales are down. But prices are sticky.

Now, we all know NOTL is special. Unlike the riffraff who inhabit the Falls or Welland, for example, we’re happy to pay absurd amounts of money to live here with the horses and gelato. The average house price across Niagara is $595,000. In this town, it’s about a million, and there’s a shocking 10 months of supply.

In Old Town?

Fuhgeddaboudit if you’re a first-time buyer. The average asking price for a pile anywhere between Mary Street and the water is close to $1.9 million — a massive increase over the region as a whole and higher than the average detached house in godless Toronto (currently $1.686 million).

Sellers have a big ask. Buyers are slow to answer it.

“Even a recent interest rate reduction wasn’t enough to overcome the ongoing economic uncertainty and affordability concerns weighing on consumer sentiment,” says Niagara realtor boss Lisa Tayor.

“This is an undervalued opportunity — motivated sellers, elevated inventory and softening prices present highly favourable conditions for buyers ready to act before year-end.”

Yes, the central bank dropped its key rate in September, bringing variable mortgage rates down. It is due to happen again at the end of this month. Then Mark Carney’s first budget in early November is expected to focus heavily on housing affordability.

Alas, nobody forecasts a price plop here. “Prices have moderated, but most buyers now realize that the dramatic price drops some were hoping for haven’t happened — and likely won’t,” says local agent Greg Sykes. ”For sellers, my advice is to stay patient but realistic. Well-priced, well-presented homes continue to attract attention.”

The reality, though, is that the buyer of a $1.9-million house needs $400,000 in cash and an income of about $220,000 to handle the $8,400 monthly mortgage payment, plus property tax and utilities. Ouch. The average income in Niagara is $94,700. In NOTL it jumps to $129,000.

So, how can this market function? Is it doomed, until sellers understand economic reality? Or will cheaper rates save us all by making debt easier to swallow?

“Most people are aware of the rate cut,” says broker Angelika Zammit. “My thoughts are that we will need two or three more cuts to see any effect on buyer enthusiasm.”

“As there is no deep discount coming, market value seems to have settled at pre-COVID prices, which is 20 per cent or more below the COVID high. Pricing correctly at the beginning of the listing is so important. It has been difficult for some sellers to make this adjustment.”

For some, impossible. Homes with an ask of $2 million and more have been sitting now for two years, or more. Buyers are waiting for a crash. Sellers smell revival.

Neither is coming.

Garth Turner is a NOTL resident, journalist, author, wealth manager and former federal MP and minister. garth@garth.ca.